No-fault states include: What Various Learn more other Factors Influence Automobile Insurance Fees? Your age as well as your house state aren't the only points that affect your prices.

Some insurance firms may use reduced rates if you do not use your automobile much. Others provide usage-based insurance policy that might conserve you cash. Insurers factor the likelihood of a car being stolen or damaged in addition to the price of that lorry right into your premiums. If your car is one that has a chance of being swiped, you might need to pay more for insurance policy.

In others, having bad debt can trigger the expense of your insurance coverage premiums to climb drastically. Not every state allows insurance companies to use the sex detailed on your motorist's permit as an establishing aspect in your costs. In ones that do, female motorists typically pay a little less for insurance policy than male vehicle drivers.

Policies that just fulfill state minimum protection needs will be the most affordable. Added coverage will cost even more. Why Do Auto Insurance Policy Prices Modification? Considering average vehicle insurance prices by age as well as state makes you question, what else impacts rates? The response is that car insurance prices can change for numerous reasons (auto insurance).

An at-fault accident can elevate your price as a lot as 50 percent over the next 3 years. In general, auto insurance coverage tends to get more pricey as time goes on.

More About Mercury Insurance: Auto, Home, Business Insurance & More

There are a number of various other price cuts that you could be able to capitalize on right now. Here are a few of them: Numerous business provide you the greatest price cut for having an excellent driving history. Also called packing, you can obtain lower rates for holding more than one insurance plan with the same firm.

Homeowner: If you have a home, you might obtain a house owner discount from a number of service providers. Get a price cut for sticking with the exact same company for multiple years. Right here's a secret: You can always contrast prices each term to see if you're getting the most effective rate, despite having your commitment discount.

low cost affordable car insured perks

low cost affordable car insured perks

However, some can additionally elevate your rates if it ends up you're not an excellent driver. Some companies provide you a discount rate for having a good credit report. When looking for a quote, it's an excellent idea to call the insurer and also ask if there are any more price cuts that use to you.

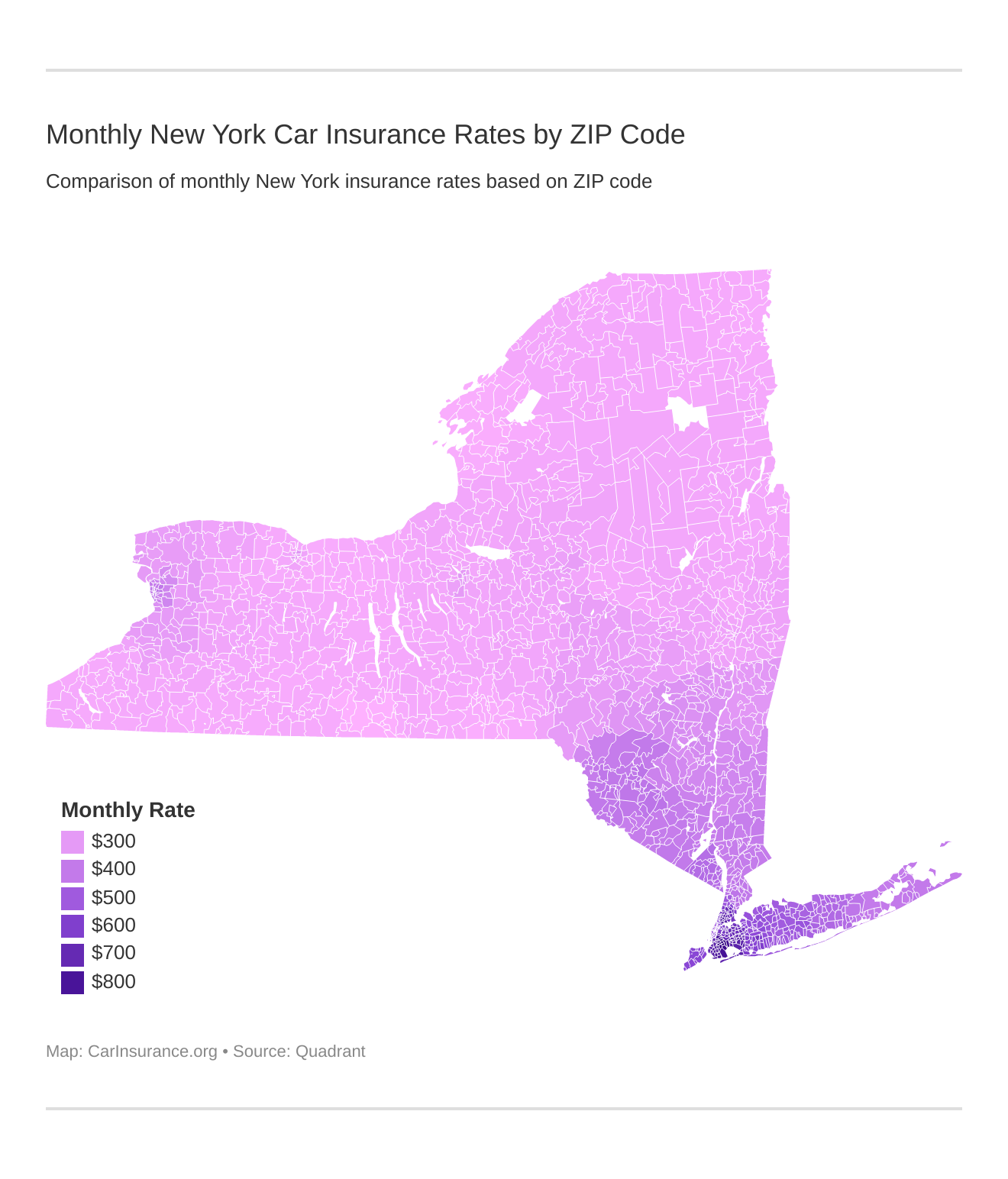

It can likewise vary within a state according to run the risk of elements in certain places., you might have a greater insurance price than a motorist with a similar account in a different place.

Minimum protection is the least costly plan you can obtain for your vehicle, however it only covers the minimum demands by legislation from the state. With full coverage, you have extensive as well as collision protection in addition to the minimal insurance coverage. Though this alternative is much more costly, it includes even more protection for your vehicle.

Facts About Average Cost Of Car Insurance In May 2022 – Bankrate Uncovered

Youthful or inexperienced drivers are a greater threat for the insurance policy business, which is why they have higher insurance coverage costs. Once chauffeurs are 30 or older, vehicle insurance coverage premiums are affected by gender.

In the states that allow gender-based prices, the difference in premiums in between men and also women is less than 1 percent. The six-month ordinary car insurance costs by gender are: Man: $734.

One of the largest variables for consumers looking to get cars and truck insurance policy is the rate. Not only do prices vary from company to business, yet insurance coverage expenses from state to state differ.

Average prices differ extensively from state to state. Relying on typical automobile insurance coverage sets you back to approximate your car insurance premium may not be the most precise means to figure out what you'll pay.

Insurance companies utilize several elements to determine rates, and you may pay basically than the ordinary driver for coverage based on your threat profile. Younger motorists are typically a lot more likely to get right into a crash, so their costs are commonly greater than standard. You'll additionally pay more if you have an at-fault accident, multiple speeding tickets, or a DUI on your driving document.

The Main Principles Of How To Save On Monthly Bills As Prices Keep Rising

It might not offer appropriate protection if you're in a crash or your vehicle is harmed by another covered occurrence. Interested concerning how the ordinary rate for minimal protection stacks up against the cost of complete coverage?

insurance cheaper cars cheaper auto insurance cars

insurance cheaper cars cheaper auto insurance cars

The only way to recognize exactly how much you'll pay is to shop about as well as obtain quotes from insurance companies. Among the aspects insurance providers make use of to establish prices is area – laws. Individuals who stay in areas with greater theft prices, crashes, as well as all-natural disasters commonly pay more for insurance. And given that insurance policy laws as well as minimal protection needs differ from one state to another, states with higher minimum requirements normally have higher typical insurance expenses.

A lot of yet not all states enable insurance firms to make use of credit rating when setting rates. In basic, candidates with lower scores are most likely to submit a case, so they normally pay more for insurance coverage than drivers with higher debt ratings. If your driving document consists of accidents, speeding up tickets, DUIs, or other infractions, expect to pay a greater premium. automobile.

Vehicles with higher rate tags generally set you back more to insure – cheap car insurance. Motorists under the age of 25 pay greater prices due to their absence of experience as well as raised crash danger. Men under the age of 25 are usually estimated higher rates than ladies of the exact same age. The gap reduces as they age, and also ladies may pay a little a lot more as they obtain older.

Because insurance policy firms have a tendency to pay even more insurance claims in high-risk areas, rates are usually greater. Celebrating a marriage normally causes reduced insurance coverage premiums. Getting appropriate insurance coverage might not be inexpensive, however there are ways to get a discount rate on your cars and truck insurance. cheapest car insurance. Here are five common discounts you may get approved for.

How Much Does Car Insurance Cost In May 2022? – Newsxpro Things To Know Before You Get This

If you own your house instead of renting it, some insurance companies will certainly provide you a discount rate on your automobile insurance coverage costs, also if your home is guaranteed with another firm. Besides New Hampshire as well as Virginia, every state in the nation needs drivers to keep a minimum quantity of responsibility coverage to drive lawfully.

It may be appealing to stick to the minimal limitations your state needs to save on your costs, but you might be placing on your own at threat. State minimums are notoriously low and also might leave you without ample defense if you're in a serious accident. Many experts recommend keeping enough protection to secure your properties.

Looking into for the right insurance coverage company that fulfills your needs is commonly the initial step, however you likely have questions concerning insurance policy providers, policies, and also rates. When contrasting quotes, you may question, what is the average expense of auto insurance? It's valuable to comprehend the variables that can influence your vehicle insurance prices – cheap auto insurance.

On a yearly basis, vehicle insurance policy expenses normally drop between $926 and $2,534 each year per automobile, but these costs can differ based upon the area, company, as well as coverage picked. Here are some of the variables that influence the expense of automobile insurance coverage: State and place Your geographical area may play a vital function in determining the costs amount for your car insurance (vehicle).

Some states also need Accident Defense (PIP) coverage as well as some areas think about weather condition and also environment when determining vehicle insurance policy costs – trucks. Find out about what car insurance policy is called for in your state. Age As a motorist with reliable vehicle insurance coverage, your prices will likely change with time, depending upon your age.

The Only Guide to Safety Insurance

This is generally due to inexperience and also harmful driving habits. cars. drivers over the age of 70 are most likely to create an accident than middle-aged motorists, yet less most likely than teen vehicle drivers. Based on this data, teen as well as elderly drivers might pay more when buying automobile insurance than middle-aged motorists.

affordable auto insurance affordable auto insurance cheaper car affordable auto insurance

affordable auto insurance affordable auto insurance cheaper car affordable auto insurance

New autos can be costly to guarantee due to the fact that they include repairs as well as greater substitute worths than older makes as well as designs. Contemporary vehicles outfitted with safety attributes and tracking abilities, may be less expensive to guarantee. Car size can likewise affect auto insurance policy expenses. In the past, SUVs were normally much more pricey to insure than sports cars or sedans, but this can also rely on the sort of SUV and some versions may be less costly to guarantee than others.

Yearly mileage When investigating how much cars and truck insurance ought to cost, bear in mind that insurance coverage premiums are based primarily on the risk connected with your vehicle. Driving document Your driving document helps respond to the question: exactly how much should I be paying for vehicle insurance policy? Vehicle insurance coverage carriers commonly pay attention to a person's experience as well as driving record.

A wedded vehicle driver can pay up to $96 much less per year for their cars and truck insurance policy. Integrating vehicle insurance coverage with residence insurance is a very easy means to conserve on your automobile insurance policy costs.

The Buzz on Car Insurance Coverage Calculator – Geico

State Farm, Travelers, as well as Nationwide likewise have insurance policy rates that are more affordable than the nationwide average, according to our study. That stated, there are a great deal of variables that influence how much you'll spend for auto insurance coverage, and also we'll consider some of them below. These car insurance coverage rates variables include your age as well as various other demographic information, your credit rating as well as credit report, your driving document, and also whether you get minimum protection or complete protection.

Car insurer typically think about elements such as your age, sex, marriage condition, home address, credit report, driving record, and the kind of auto you drive, along with the insurance legislations and also policies in your state. insured car. Purchasing around is the ideal means to discover the very best cars and truck insurance policy rates. See to it to contrast quotes from several various insurer.

Our research study established average automobile insurance coverage prices for a selection of client teams, there are a great deal of individual aspects that might make your rates lower or greater than those revealed right here., as well as various other ways to cut prices.

Leave a comment